If you’re new to the world of alternative finance, cryptocurrencies might seem like an intimidating concept. Bitcoin is the most famous cryptocurrency, but there are a number of others of which Ethereum and Litecoin (after Bitcoin) for example are the most widely used today that provide an alternative to savvy investors.

With the increasing instability of the world economy and uncertainty about the dollar and other traditional currencies, investors began looking to cryptocurrencies as a hedge against inflation and economic shocks. If you’re looking to survive in an increasingly volatile market, cryptocurrencies are a worthy option for you to consider.

Cryptocurrencies Simplified

Cryptocurrencies, as the name implies, are currencies that use elements of cryptography to allow safe, secure transactions over the Internet. Unlike traditional fiat currencies, which are controlled by a central authority (usually a government), cryptocurrencies are decentralized, with no one entity or individual capable of solely controlling the creation of money.

Instead, cryptocurrencies generate new money collectively through processes that are extremely difficult to manipulate. For example, Bitcoin generates new currency through “mining,” which involves using computer programs to record and process transactions through a mathematical formula.

Because of the nature by which cryptocurrencies propagate themselves, it is impossible for central authorities such as governments to produce or back them. Cryptocurrencies are designed to be immune from manipulation by individuals or groups acting alone, theoretically making them more stable than traditional fiat currencies.

How Cryptocurrencies Work

While details vary in the implementation of individual currencies, most are based off the framework established by Satoshi Nakamoto, the creator of Bitcoin, several years ago. The integrity and safety of a cryptocurrency is maintained by a community of parties typically known as miners, whose responsibility is to monitor the cryptocurrency network in exchange for a small payment.

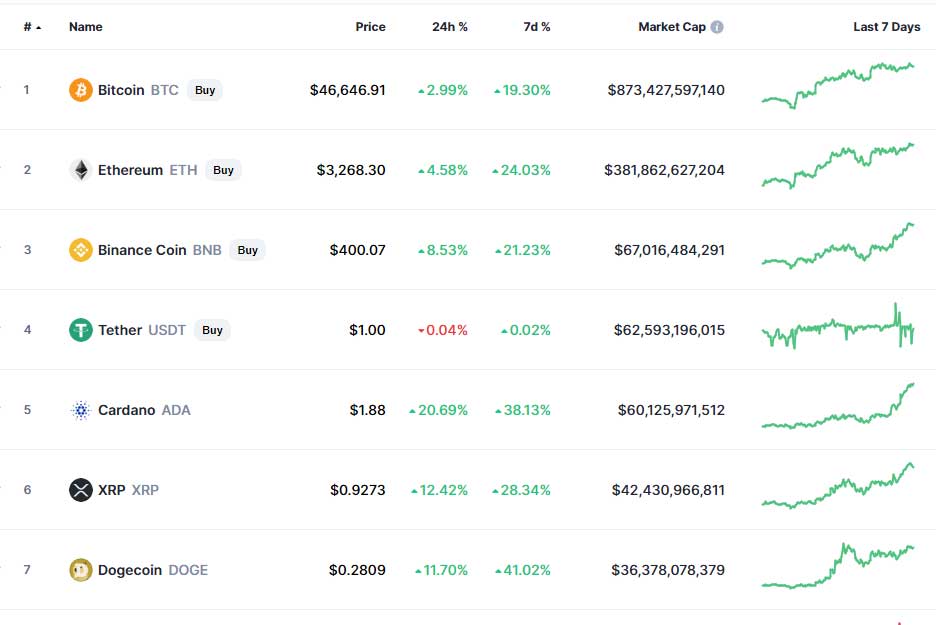

Cryptocurrency Market Cap

These miners use computer programs that log and process all global transactions with the cryptocurrency in question, enabling the network to solve mathematical equations that protect users against fraud. The more computers that are running these mining programs, the less likely that any individual or group will be able to subvert the cryptocurrency for its own gain.

Because cryptocurrencies are fiat currencies that have no physical form, it is theoretically possible to generate an infinite number of them, which would lead to hyperinflation and economic collapse. To prevent this, most cryptocurrencies have a built-in cap on the amount of money that will ever be in circulation. This has led to a risk of hyper-deflation as certain cryptocurrencies reach their currency limits.

Cryptocurrencies: The Future of Finance?

While it’s unlikely that cryptocurrencies will ever supplant traditional ones, their longevity and growing popularity suggest that they are here to stay. Utilizing the power of the Internet and modern computers, cryptocurrency programmers have created an exciting new world for finance, one that prudent investors would be wise to pay attention to.

Robert Kiyosaki – The Corruption Of The US Dollar

In the video, well known financial advisor and motivational speaker Robert Kiyosaki chats about what’s going on inside the massive world of cryptocurrencies and why he has never trusted the dollar or trusts the government.