A down to earth review on Anthony Morrison’ latest mentorship program – The PWA Program 2019

Signs of sleep deprivation but… Nevertheless, it is an honest and truthful review totally based on using the program as a student/partner

Freedom Seekers

Signs of sleep deprivation but… Nevertheless, it is an honest and truthful review totally based on using the program as a student/partner

The most devastating stock market crash in the history of the United States;

Its from my favorite documentary by PBS – New York.

This particular part about Wall Street crash of 1929 is from episode 5 of the series with title: Cosmopolis. There are lots of archive photos, footages and drawings throughout the series and in my opinion it was great work done with finding them. series website: http://www.pbs.org/wnet/newyork/series/index.html

“Archival shoots took place at various historical and cultural institutions, including the New-York Historical Society, the Museum of the City of New York, and the Library of Congress, and focused on the filming of particularly rare or large-scale archival prints, lithographs, maps, and photographs”

The stock market crash of nineteen twenty-nine is considered to be the greatest catastrophe in American history next to the civil war. This crash also had an enormous effect on the economic and political climate of Europe and helped to exacerbate the conditions which led to the destruction of World War II. But what were the causes of this calamity?

Before we get into the greater causes let’s look at the conditions which set up for the collapse. For about a decade the American economy was, for the most part, booming following the end of the Great War. Since the United States much like Britain didn’t have to rebuild its infrastructure, industrialists were able to produce at incredible rates which led to lower prices.

Low prices for goods in addition to the skilled and semi-skilled labor of soldiers returning from the war meant wealth for the majority of Americans. While not producing at the same industrial level European farmers, like their American counterparts produced a surplus of food which drove prices down as well.

Now onto the causes. Spurred by the promise of quickly becoming rich off the stock market many Americans began to invest more and more into stocks and bonds without having adequate understanding of the means by which the market functioned. Foolhardy investments in addition to borrowing on the margin and other factors led to a speculative bubble which violently burst in the fall of nineteen twenty-nine. With the crash came a ninety percent drop on the value of the Dow as well as banks runs and failures as well as rising unemployment.

In a bid to protect American farmers Congress was proposed prior to the crash in the form of Smoot-Hawley tariff. This tariff was to severely limit the import of foreign goods particularly subsistence. Passed in nineteen thirty the bill won the ire of the European community which imposed their own retaliatory tariffs on American goods.

This response along with the effects of the American Dust Bowl worsened the effects of the twenty-nine Crash, and according to some economists in a far greater measure then previously appreciated.

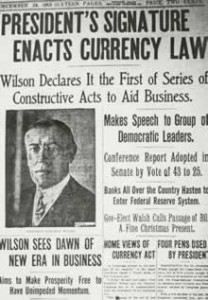

However an often overlooked factor was the control of the money supply by the United States third central bank the Federal Reserve. Mainstream monetarists argue that the FED took the wrong steps in addressing the Crash, Heterodox Austrians blame most of the crash and subsequent depression on the FED directly.

Citing the manipulation of credit Austrians point to the FEDs coercive control on the market as the reason the stock market crashed as well as its delayed recovery over the following decades. While this explanation was not initially accepted this fact too has now even been acknowledged by former FED chair Ben Bernanke who stated before monetarist Milton Friedman:

“Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.”

Given the FED’s contribution to the most recent economic recession which may get even worse, we can only hope.

Our concept is straight forward. Bring to the camp the best sources of information on a vital and somewhat complicated affair, making money.

Our concept is straight forward. Bring to the camp the best sources of information on a vital and somewhat complicated affair, making money.

Obviously we are all affected directly and indirectly. The reality of gaining reliable information can be elusive and downright dangerous via misinformation. Reasons usually fall into two categories, deception (greed) and or ignorance (blind leading the blind.)

Instinctively our interest from day one is to better ourselves, too learn and prosper mentally, physically and financially.

When we were children my dear uncle always made us laugh when toasting the New Year. Every year he would wish us good luck in being healthy, wealthy & wise but as he had a slight speech impediment, it came across as helsy, velsy and vize. So, with fits of hysteria we would mimic him which was pretty cool as those words stuck for life and as simple a statement as that was, it is of course deeply profound.

This site offers solid benefits. My financial experience for example is gleaned from forty entrepreneurial years, setting up and operating various business models in an array of climates. If there is one thing I learned above all else, it’s that you can be sure to witness cycles! Just as you probably heard in market chatter of bulls and bears, the reality is that over the years we have the same, well same in principal – cycles.

I am in the process of writing a series of books to benefit people that have the hunger to fulfill ones dream in gaining financial freedom. My humble wisdom though is shared with you in a hard and fast, warts and all, truthful instruction which may not be to everyone’s taste. You have been warned!

My fundamental philosophy in a nutshell is to be totally honest with oneself and to remember that adage, what you put in is what you get out. Chaucer quoted “Nothing ventured, nothing gained” whereas Abraham Lincoln said “Actions speak louder than words.” I mean who can argue with these guys?

When I ventured into the world of commerce all those years ago, gleaning fast stats on a town or city usually meant a trip to the local library armed with coin, notebook, pencils and a sandwich. The coins, would you believe, were for public telephone boxes!

Today of course information is accessible in a flash. Anyone can be reached anywhere, bets can be placed instantly, markets can be flooded in seconds and all from an armchair in the shed! Wow, you lucky people…

Here you will have the opportunity of accessing an inner circle of business masters. If that sounds expensive, and so it should by the way, I can inform you that you will be pleasantly surprised as we at MA Camp have an interesting agenda. As I mentioned earlier, we are like-minded individuals who are happy to share our trials and tribulations, experience and advice in sensible and practical ways.

Thank you for visiting us online. We look forward to your visits so we can make it our business to help you grow your business with sound advice and resources